A simple, transparent process that gives you confidence at every step.

From Call to Capital: Your Path to Partnership

Investing shouldn’t feel like a black box. That’s why we’ve created a process that is simple, clear, and designed to put you back in control. From your first call to your final distribution, every step is structured to give you clarity, confidence, and transparency. No surprises, no jargon, just a proven path you can trust.

A Simple 3-Step Framework

We believe the best strategies are also the simplest. First, you schedule a call so we can walk you through our model and answer your questions. Next, you review and invest in opportunities that have already been vetted and structured for success. Finally, you watch your capital grow in real, tangible assets, land you can see, touch, and trust.

Step 1

Schedule a call and walk through our model with us.

Step 2

Review and invest in vetted, structured opportunities.

Step 3

Watch your capital grow in real, tangible assets.

What Happens After You Invest

Once you commit, the process remains clear and predictable. You’ll complete onboarding, fund your investment through a capital call, and receive regular project updates. As milestones are reached, distributions are made according to the investment structure. At every stage, you’ll know exactly where your capital stands and what comes next.

Onboarding

Complete onboarding and get set up as an investor.

Capital Call

Fund your investment when capital is called.

Project Updates

Receive regular reports and progress updates.

Distributions

Receive distributions as milestones are reached.

Confidence Through Transparency

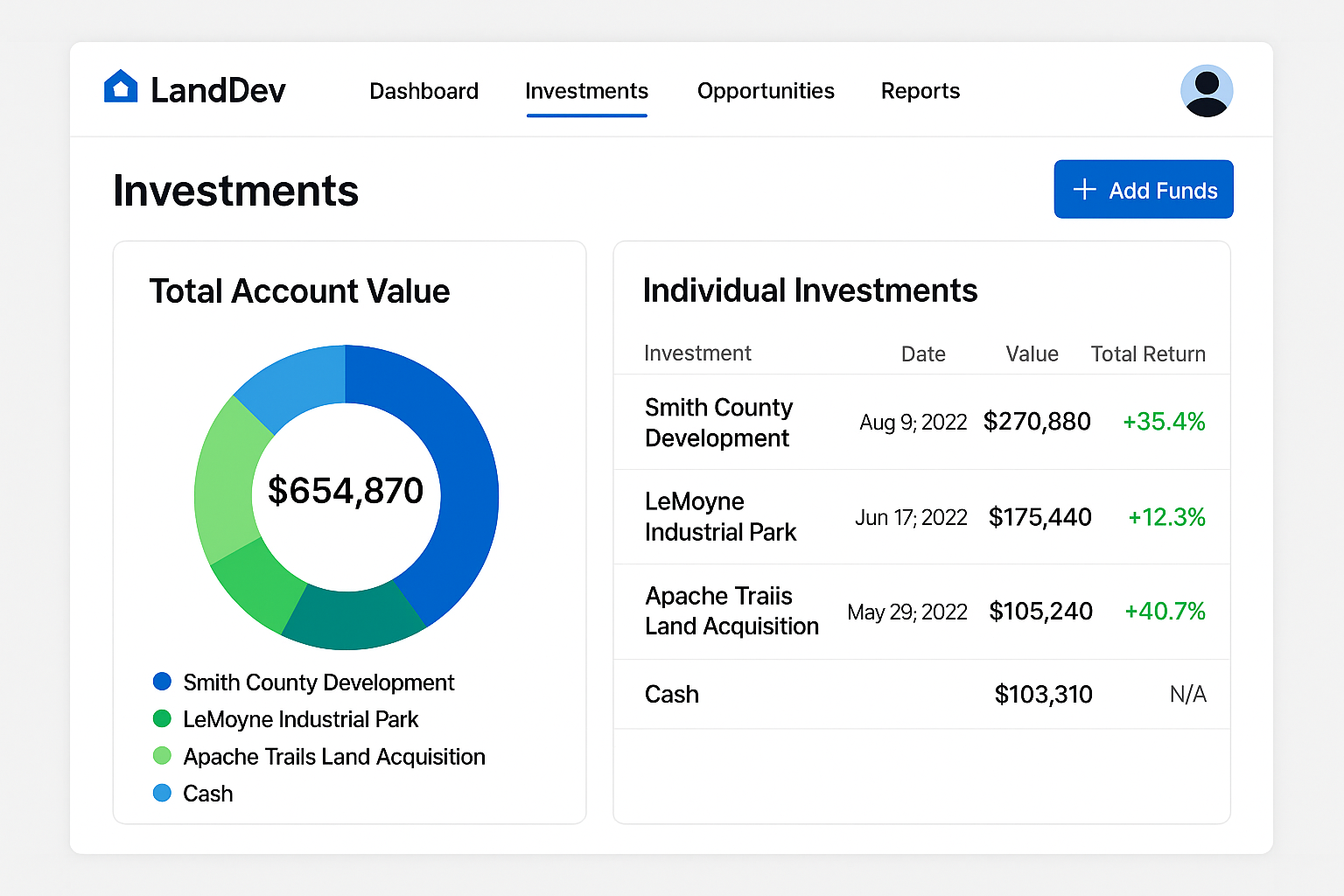

Your time is valuable, and your trust is priceless. That’s why we deliver clear quarterly reports, site photos, and timely updates without burying you in unnecessary noise. You’ll also gain access to a secure investor portal where you can track progress, review documents, and monitor distributions at your convenience. We do the heavy lifting so you can stay focused on your life and goals.

Common Questions, Straight Answers

We address the most common concerns upfront: How long is the typical holding period? What happens if the market slows? What risks remain? Our answers are clear, practical, and designed to build confidence so you always know what you’re saying “yes” to.

Do I need to be an accredited investor to participate?

Yes. As defined by the SEC, an accredited investor, in the context of a natural person, includes anyone who:

- Earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, OR

Has a net worth over $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the primary residence).

For more information, please review the SEC’s definition of an accredited investor.

Can I invest if I am not in the real estate or finance industry?

Absolutely. Our investors come from a wide range of professional backgrounds. What unites them is a shared desire for control, transparency, and lifestyle-aligned investing.

What are the tax advantages of investing in real estate through this fund?

While we are not tax advisors, real estate offers unique advantages and the ability to offset certain income streams. These benefits often make real estate cash flow more tax-efficient than many traditional investments. We encourage you to discuss your personal situation with your CPA.While we are not tax advisors, real estate offers unique advantages and the ability to offset certain income streams. These benefits often make real estate cash flow more tax-efficient than many traditional investments. We encourage you to discuss your personal situation with your CPA.

Can I invest using 1031 exchange funds or retirement accounts?

No. Per the rules of the SEC this fund does NOT qualify as a 1031 exchange unfortunately. However, we also work with investors who use self-directed IRAs or solo 401(k)s to place tax-advantaged retirement capital into real estate. Please contact us to discuss your specific situation.

What types of real estate projects does this fund invest in?

Our strategy focuses on land development with strategic builder partnerships for custom homes. This hybrid model combines the scalability of land development with the premium exit values and faster absorption rates associated with custom-built housing. Unlike pure development or pure vertical builders, this approach balances risk with attractive upside potential.

How and when will I receive distributions?

We target quarterly distributions once projects move into the income-producing or exit phase. Each offering clearly outlines its projected timeline and distribution structure. Please note, as with all investments, distributions depend on project performance and are not guaranteed.

What makes your fund different from other real estate investment opportunities?

We are not chasing institutional-scale apartments or retail complexes with heavy operational risk or land meant for first time homebuyers which have stalled in the current macro environment. Instead, we focus on land meant for custom homes and target the almost recession proof affluent high-net worth consumer in markets with strong lifestyle appeal. By partnering directly with trusted custom builders with a pipeline of customers seeking land, our exit strategy is clearly defined which translates into faster, more dependable returns almost

Ready to Start the Process?

Take the first step toward independent, values-aligned investing

You’ve worked too hard to let your wealth sit in vehicles that don’t reflect your values. Our process is designed for investors who want clarity, control, and a clear path to results. Schedule a call today, and let’s begin building something real together.